One day, not too long ago, I showed up at the KnowItAll's house about lunch time and they shared a delicious meal with me. Another delicious thing over at their house is good conversation and we got to talking about the middle class and what it means today. After I went home, that conversation stayed with me and I kept mulling it over, so I decided to turn the MoneyPenny Research Department loose on it and they came up with some interesting information.

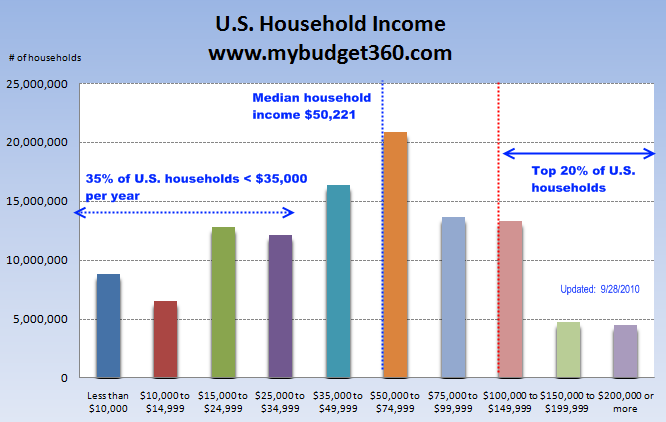

I looked at lots of graphs and charts and decided on this one from mybudget360.com because it is very clear and easy to understand. It is also kinda big but I wanted you to be able to see it.

You can see that "median" income is $50,221, which means half of households live on one side and half on the other side of that figure. 35% of us live below $35,000 which makes me wonder why all of us think that we are in the middle class or better.

Here is a rough breakdown on just what the many levels of "middle class" are:

Upper Middle Class $100,000-$150,000

Middle Class $ 60,000-$100,000

Lower Middle Class $ 32,500-$ 60,000

Working Class $ 23,000-$ 32,500

I threw in the last category because now that I am not working, I have, strangely enough, slid down into the Working Class.

I think that this information is important because, and as my friend, Jeannie, said today, it can help us get to reality when it comes to our finances. Are our spending and financial planning really in line with our place on the graph?? And if they aren't - what do we need to do to get in that upper level?? More education or training or move?? Or is it even possible?? Do we even really want to make that kind of effort and commitment?? Where are we on the age graph?? Good questions.

If moving up into a higher income bracket isn't in the stars, getting real about spending and financial planning is the answer. Otherwise, we could be putting our home and family at risk by living beyond our means. Credit cards can only take you so far and then they get ugly. I'm thinking that having your car repossessed or your home foreclosed on can't be much fun, either.

As I look at these figures, it has occurred to me that I've spent almost 10% of my entire annual income on vet bills!! When you look at it like that, it becomes very real. And scary. It is driving home the sad truth that I can't afford my animals on a Working Class income, so attrition is in order. I've been happily collecting pets like someone in the Upper Middle Class or maybe even higher up than that!!

Bird Guide Drawing Reminder:

Leave a comment on this blog or "like" on Facebook to get entered into the drawing for the Birds of the Puget Sound Region book by Christmas Eve. This is a great guide for local birds.

No comments:

Post a Comment